We have loan officers in your community that thrive on helping you find the right mortgage to fit your needs.

Explore various loan program options for fixed and adjustable rate mortgages.

Our mortgage calculators help you hone in on your future mortgage based on options, interest rates, and more.

Get started with our secure application. It's a few quick questions that take about 12 minutes to complete.

D A Griffin Financial a MORTGAGE BROKER located in Fort Thomas, KY, licensed in the states of KENTUCKY and OHIO, with over 27 years in the industry, providing home mortgages for home purchase or refinance.

A pre qualification with a seasoned professional is a great first step and allows you to shop with confidence.

By the way, did we mention pre qualifications are free? We can give you immediate feedback on the phone. Don't wait, call today!!

D. A. GRIFFIN FINANCIAL, LLC

859-442-9700

Email: dora@dagriffinfinancial.com

Follow my blog at: activerain.com/blogs/doraloans

Like our facebook page: https://www.facebook.com/dagriffinfinancial

We send out Bengal and Reds magnets each season, email me to be added to the mailing list. It's a handy reference for these teams as well as college football teams.

Nmls 1264/6380

What makes D.A. Griffin Financial, LLC unique is we offer the following niche programs as well: 3% DOWN CONVENTIONAL, FHA, VA, USDA, ELITE PRICING, High Balance Loan Pricing, Low PMI rates, Jumbo, Construction Per. FAST APPROVALS AND CLOSINGS.

Contact D.A. Griffin Financial, LLC today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

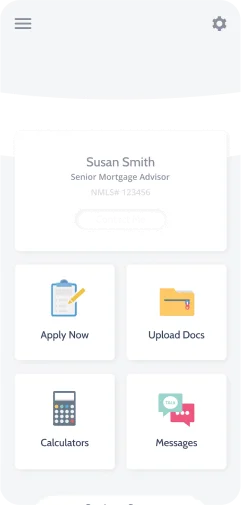

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

880 Alexandria Pike, Ste 203

Fort Thomas, KY 41075

Phone: (859) 442-9700

dora@dagriffinfinancial.com